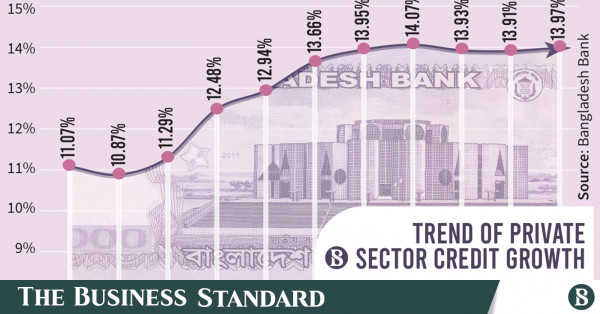

Non-public sector credits remained gradual with a 13.92% year-on-year enlargement in November 2022, reflecting slowdown in financial actions amid liquidity scarcity and prime inflation.

The banking sector has been going thru a slowdown in credits enlargement since September, breaking the upward pattern of the former six months as a result of import restrictions imposed by way of the Bangladesh Financial institution to avoid wasting foreign currency reserves.

Non-public sector credits, which grew to fourteen.07% in August – on the subject of the financial goal of 14.1% set for the present fiscal 12 months, dropped to 13.93% in September. Credit score enlargement within the subsequent month used to be 13.91%, consistent with Bangladesh Financial institution information.

Alternatively, a central financial institution find out about has discovered that the true deepest enlargement used to be some distance beneath the seen enlargement as prime depreciation ate up deepest credits.

Infographic: TBS

“>

Infographic: TBS

The find out about document launched just lately presentations that non-public sector credits enlargement in June remaining 12 months used to be 13.7%, in September 14%, and in October 13.9%, when the trade rate-adjusted enlargement used to be 11.9%, 10.9%, and 10.8%.

The trade rate- and world price-adjusted enlargement charges had been a lot decrease at 6.6%, 7.3%, and eight.8% throughout the similar duration.

The trade price of the taka in opposition to $1 depreciated by way of 16.47% to Tk99 in November remaining 12 months from Tk85 in the similar duration a 12 months in the past.

Alternatively, banks at the moment are spending Tk105 in step with greenback for import agreement.

The find out about notes that non-public sector credits enlargement is principally pushed by way of export-import financing because of prime trade price prices.

The expansion of export-import financing with regards to the native foreign money climbed to 19% in September remaining 12 months, which used to be 9% in the similar duration earlier 12 months. However with regards to the dollar, the expansion used to be damaging 0.5% – that means banks had been spending more cash for much less quantity of export-import.

Mohammad Ali, managing director and leader govt officer (Present Fee) of Pubali Financial institution, informed The Trade Same old that there are two views of credits enlargement – borrowing by way of new marketers has greater and borrowing by way of industries and importers could also be on the upward push.

Industries reminiscent of feed generators or flower generators are uploading uncooked fabrics, and their funded debt has additionally greater, he discussed. Ali stated loans within the garment sector also are expanding as in comparison to previous, probably the most causes for this being taking loans to pay worker salaries as their bills are deferred.

But even so, a surge in inflation has additionally ended in a upward thrust in call for for operating capital, contributing to an building up in borrowing, the Pubali Financial institution MD endured.

Selim RF Hussain, chairman of the Affiliation of Bankers Bangladesh (ABB) and managing director of Brac Financial institution, alternatively, stated the recent loans don’t seem to be the only real explanation why in the back of the expansion in deepest sector credits.

“Many loans are being rescheduled, and it’s not right kind to peer them as new loans. I feel rescheduled loans will likely be a large a part of this enlargement. Even if we all know the tips of particular person banks, simplest the central financial institution can shed light on statements about all the sector,” he stated.

Taking taka depreciation in attention, the central financial institution is making plans to inject more cash into the banking gadget within the upcoming financial coverage for the following six months of the present fiscal 12 months, stated a senior govt of the Bangladesh Financial institution.

Even if inflation is prime, the rise of cash provide won’t create additional fee drive as actual credits enlargement is low, the legitimate stated.

Additionally, the federal government has revised up the inflation goal to 7.5% for the present fiscal 12 months from 5.6% projected within the present finances. In consequence, the central financial institution gets extra space to extend cash provide preserving inflation throughout the goal, the legitimate added.

Inflation cooled down to eight.71% in December after selecting as much as 9.5% in August remaining 12 months.

The federal government additionally approved the industrial slowdown because it revised up main financial signs in its finances, bringing stability with the brand new truth.

Export enlargement goal has been minimize down to six% from the true 20% whilst import enlargement now has a brand new goal of damaging 4%, consistent with a presentation at a gathering of the Financial Coordination Council on Fiscal, Forex and Trade Fee on 20 December.

The assembly additionally minimize the GDP enlargement goal by way of 1 share level to six.5% within the revised finances on the finish of the present monetary 12 months.

The minimize down in import-export enlargement hints that it’ll additional squeeze deepest sector credits.

Banks remained wary in lending amid the liquidity crunch that originated from the greenback disaster, inflicting slowdown in credits enlargement, stated business insiders.

Additionally, prime inflation diminished intake which additionally contributed to gradual credits enlargement.

Hovering commodity costs have put drive on financial institution deposits as persons are slightly having any cash left to park in banks after assembly the greater price of residing – some are even going for encashment in their deposits to have each ends met.

On best of this, banks’ greater spending on greenback purchases and an upsurge in credits flows to the non-public sector are drying up liquidity within the banking gadget.

Deposit enlargement dropped to 7.35% in October, lowest in recent years, when it used to be above 9% in the similar duration of 2021, central financial institution information presentations.

Amid this case, the Bangladesh Financial institution raised the lending price cap on client loans to twelve% in November remaining 12 months after two and a part years of surroundings the rate of interest ceiling at 9% for every type of loans.

On the similar time, the central financial institution lifted the ground on deposit charges that used to be capped above inflation in August remaining 12 months to offer protection to depositors’ hobby.

Maximum banks raised the rates of interest on their client loans to double-digit from 1 December, stated business insiders.

The federal government could also be borrowing from the Bangladesh Financial institution as an alternative of business banks to offer area to the non-public sector amid the liquidity disaster.

The federal government borrowed Tk37,000 crore from the Bangladesh Financial institution in July-November 2022 whilst it paid again Tk21,000 crore to industrial banks.

The central financial institution equipped this quantity to the federal government thru injecting recent cash into the financial system, consistent with the central financial institution information.

Supply By means of https://www.tbsnews.internet/financial system/private-sector-credit-remains-sluggish-november-561990