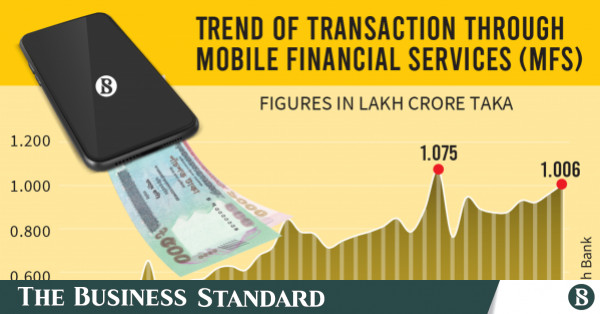

The month-to-month transactions via cell monetary services and products (MFS), corresponding to bKash, Nagad and Rocket, surpassed Tk1 lakh crore in January this yr for the second one time for the reason that release of the services and products in 2011, in step with the most recent Bangladesh Financial institution information.

The transactions amounted to Tk1,00,593 crore within the month, which is 4.64% upper in comparison to that of the former month and 18.65% upper than the similar month a yr in the past.

Except for the document in quantity, the cell monetary provider sector additionally witnessed the very best transactions, 46.30 crore in quantity, in January 2023. The quantity is 3.5 crore upper than the former month.

The rustic noticed the primary document of crossing Tk1 lakh crore-mark in MFS transactions in April 2022, centring the most important non secular competition Eid-ul-Fitr. Sector insiders imagine that MFS transactions will sign up new data ahead of this yr’s Eid as neatly.

“Individuals are changing into used to virtual transactions day-to-day. The choice of our purchasers has already reached 6.7 crore, which is an affidavit to that,” Shamsuddin Haider Dalim, head of company communications at bKash, advised The Trade Same old.

“Cell monetary services and products have made lifestyles a lot more uncomplicated via providing various handy services and products. Additionally, we try so as to add new merchandise regularly.”

“In our remark, other folks proceed to transact and use other services and products when they use bKash for the primary time, which means that that they consider bKash,” Shamsuddin Haider stated, including that the transactions were on the upward thrust in such tactics.

But even so, the usage of MFS via the governments for distributing other allowances additionally contributed to the surge in transaction quantities, he famous.

An research of January information presentations that transactions in all spaces together with cash-in, cash-out, person-to-person steadiness switch, and wage distribution have larger considerably. Essentially the most important expansion, 14% year-on-year, used to be observed in service provider bills to succeed in Tk3,373 crore.

The full choice of MFS accounts stood at 19.41 crore on the finish of December final yr, in step with the central financial institution, whilst some 2.1 crore accounts have been added in that yr on my own.

The Bangladesh Financial institution accepted cell banking in 2010. It got here into operation early subsequent yr with the release of Rocket, an initiative of Dutch-Bangla Financial institution. These days, 13 banks supply such services and products within the nation beneath other names corresponding to bKash, UKash, MyCash and SureCash.

Supply Through https://www.tbsnews.internet/economic system/monthly-mfs-transactions-surpass-tk1-lakh-crore-second-time-600802